capital gains tax news in india

So for example say you bought into. Capital gains tax for property sold by NRI.

What Is Capital Gains Tax And When Are You Exempt Thestreet

To understand the notion of Capital Gains Tax one needs to be.

. The Tax on the Long Term Capital Gain of 10 is. It was announced that long. The Tax applied on the Long Term Capital Gain Tax for properties is 20 plus surcharge and cess as applicable.

The investortaxpayers is exempted from paying any tax if the LTCG is below Rs 1 lakh. Sunday October 16 2022 Breaking News. August 6 2021.

Let us summarize everything in. NRIs who sell property situated in India have to pay capital gains tax in India. You owe capital gains taxes on the profit that you make whenever you sell an investment asset or receive qualified dividend payments.

Income deemed to accrue or arise in India - salary income as accrued t. 26 Oct 2016 India-Korea revised DTAA notified capital gains to be taxed at source from April 1 India has notified the revised double tax avoidance agreement with South Korea. Long-term capital gains are taxed at a flat rate of 20 per cent plus cess and surcharge unless an exemption is claimed.

Addition us 69 rws 115BBE - Heigher rate of income tax - The applic. TIMESOFINDIACOM Nov 01 2021 1637 IST As per the standard income tax rules the gains on the crypto-transactions would become taxable as i Business income or ii. According to the Income Tax Act capital gains tax in India need not be paid.

Akin to Section 112A Section 111A specifies the rate of capital gain tax to be 15 plus applicable surcharge and cess on the gains arising from the transfer of a short-term. In case the transaction qualifies to attract long-term capital gains LTCG a tax rate of 20 will be applicable on the sale. The KPMG member firm in India has prepared reports about the following tax developments read more at the hyperlinks provided below.

According to the Income Tax Act this comes under capital gains. The Capital Gains Tax CGT depends on whether the gain was made quickly or over a long period. The India section covers parliament passing budget proposals and discusses no beneficial ownerships requirements are needed for capital gains tax exemption.

But the top 20 rate wont hit single individuals until their income exceeds. For individual filers the 15 capital gains rate kicks in on income above 44625 in 2023 up from 41676 in 2022. Any profit earned beyond the given indexation of property in the long term is taxable at 20 per cent.

This is called a 1031 exchange and it allows you to defer the tax on the sale. This guide tells you everything you need to know about capital gains and the tax applicable on it. Inside the Plane Crash That.

Unexplained cash deposits in bank. 20 Dec 2021 1044 PM IST Archit Gupta. The following percentage of tax deduction is available under such.

LTCG of below Rs 1 lakh gets capital gain exemption ie. Tools To Nullify or Minimise Capital Gains. The structure of Capital Gains Tax in India has witnessed many changes since it was first introduced in 1997.

The calculation of long term capital gains tax has been explained in the table below- Cost Inflation Index and its impact on Capital Gains Value of money is constantly. Major income tax changes in last 10 years and how they have impacted your investments One of the changes announced was in April 2018. Another way to avoid capital gains tax is to reinvest the profit from the sale into another property.

If in above case Stamp Duty Value of property is INR 60 Lac then 60 Lac shall be considered as Sale Value and capital gains would be Rs 28 Lac. The tax that is charged on long term and short term gains starts from 10 and 15 respectively.

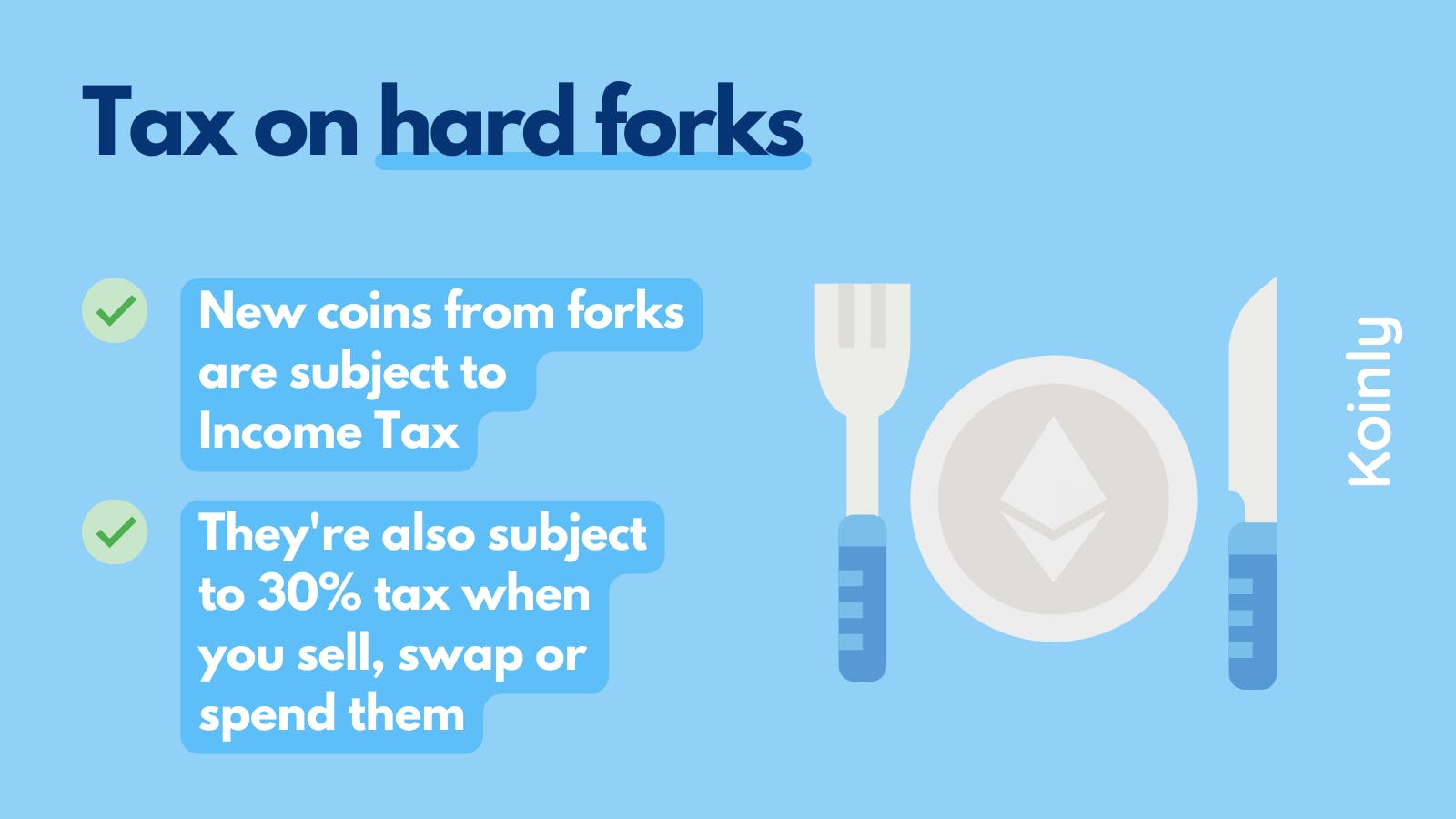

Crypto Tax India Ultimate Guide 2022 Koinly

How Democrats Would Tax Billionaires To Pay For Their Agenda The New York Times

Capital Gains Tax What It Is How It Works And Current Rates

Crypto Tax India Ultimate Guide 2022 Koinly

Capital Gains Government Open To Some Tinkering In Capital Gains Tax Regime Revenue Secretary Tarun Bajaj The Economic Times

Explained Rise In Collections From Capital Gains Tax Levy Explained News The Indian Express

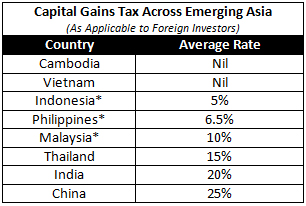

Capital Gains Tax China Briefing News

Tax Implications For Indian Residents Investing In The Us Stock Market

There S A Tricky Virtual Currency Question On Your Tax Return

Cairn Liable To Pay Rs 10 247 Crore Capital Gains Tax Itat Nangia Andersen India Pvt Ltd

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Long Term Capital Gain Tax On Equity Mutual Funds Youtube

Capital Gains Tax In India An Explainer India Briefing News

Tax On Employee Stock Ownership Plan Is As Perquisites Or Capital Gains Chirag Nangia Nangia Andersen India Pvt Ltd

Long Term Capital Gain On Property Owner Critical Things To Know

Coronavirus Tax Relief Covid 19 Tax Resources Tax Foundation

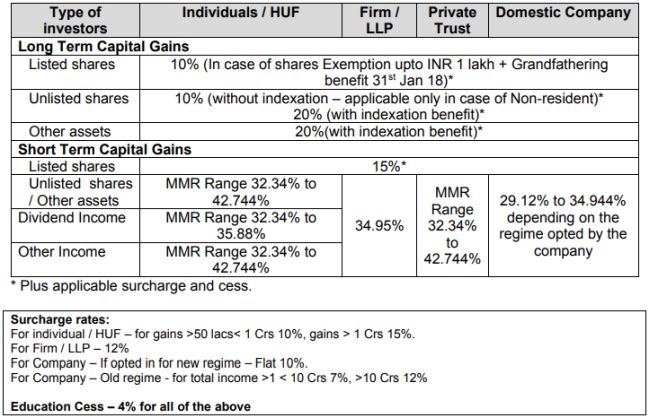

Taxation And Disclosure Requirements For Investment In Aif An Investor Perspective Withholding Tax India

Tactics To Reduce Your Capital Gains Tax And Your Estate Tax